Chamberlain Global Tokyo Japan Reviews Sir John Templeton’s Timeless Financial Wisdom

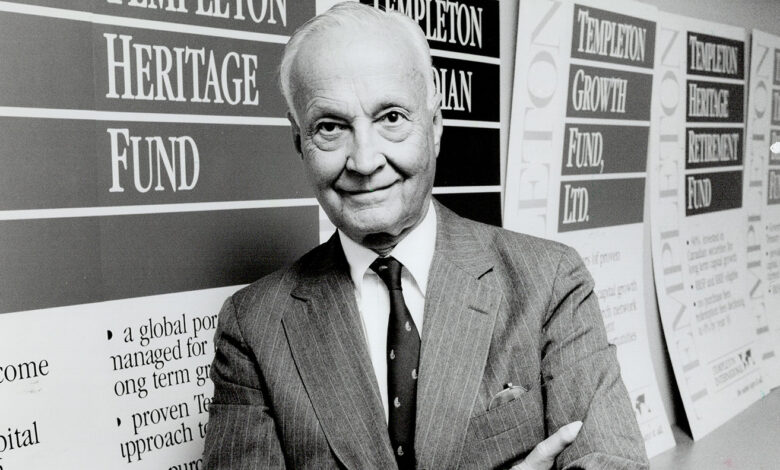

Sir John Templeton, renowned as one of the greatest investors of the 20th century, left behind a legacy of wisdom that continues to resonate long after his passing. Templeton’s principles, developed during his career from the 1950s to the early 2000s, offer valuable lessons for investors navigating the complexities of modern markets.

Chamberlain Global Tokyo Japan explores some of his timeless investment wisdom, which remains highly relevant this year.

Background and Legacy

Sir John Marks Templeton was a British-American investor, banker, fund manager, and philanthropist. In 1954, he made his mark in the mutual fund industry by establishing the Templeton Growth Fund, which achieved an average annual growth rate of over 15% for 38 years.

Sir John Templeton founded the John Templeton Foundation in 1987, generously allocating a significant portion of his wealth to philanthropy. In recognition of his extensive philanthropic efforts, Queen Elizabeth II knighted him as Knight Bachelor that same year.

Financial Principles

Sir Templeton was an early adopter of emerging market investments in the 1960s; Money magazine recognized him as one of the century’s most outstanding global stock pickers in 1999.

As someone recognized for his investment knowledge, these are his investment tips:

Investing with a Contrarian Mindset

Templeton’s investing philosophy emphasized buying when others were selling in despair and selling when enthusiasm inflated prices. This contrarian approach suggests that market sentiment can mislead investors. When an asset falls out of favor, and prices drop, it may present an ideal buying opportunity for astute investors.

Conversely, when excessive optimism drives prices to unsustainable levels, selling could be wise. According to Chamberlain Global Tokyo Japan, Templeton’s principle highlights the importance of resisting herd mentality and instead focusing on intrinsic value and opportunity.

Commit to Long-Term Investments

Templeton advocated for long-term investing, urging investors not to be swayed by short-term market fluctuations. He cautioned against focusing solely on temporary factors, like quarterly earnings reports. Instead, he advised concentrating on investments’ fundamental strength and long-term potential.

His approach underlined the belief that patience and a long-term perspective often lead to the most rewarding outcomes.

Diversification as a Safety Net

Diversification was a cornerstone of Templeton’s strategy. He believed in spreading investments across different sectors, industries, and regions to mitigate risk. By diversifying, investors can safeguard their portfolios against the volatility of any single investment.

Templeton’s emphasis on diversification remains vital, especially in today’s interconnected global markets.

Learning from Mistakes and Avoiding Overconfidence

Templeton understood that mistakes are part of investing, but how one responds is crucial. He stressed the importance of learning from errors and avoiding the temptation to recover losses through high-risk strategies.

Additionally, he warned against overconfidence, urging investors to remain adaptable and continuously question their strategy in an ever-changing market landscape. Financial firms like Chamberlain Global Tokyo Japan can review your strategy and update it to adapt.

Templeton’s Timeless Investment Wisdom

Sir John Templeton’s timeless wisdom guides novice and experienced investors. His principles offer a solid foundation for successful investing in today’s dynamic market. Embracing these insights can help investors make more informed decisions and build a resilient investment strategy.