Manual vs. Automated Financial Close: Which is Right for Your Business?

Every month, quarter, or year, businesses deal with critical financial close processes. It’s the time to finalize accounts, ensure accuracy, and prepare for what lies ahead. How a company handles this process can make all the difference in driving efficiency and growth. Yet, many businesses are left wondering whether to maintain their manual processes or shift to automated solutions.

For smaller businesses, manual closes often feel familiar and manageable. However, as companies expand, this method can lead to inefficiencies and delays that hinder progress. Thus, the choice between manual and automated financial close becomes essential for streamlining operations and supporting long-term success.

Keeping this in mind, in this blog, we’ll discuss the key differences between manual and automated financial closes, helping you determine which method aligns best with your organization’s needs and goals.

Manual Financial Close Process

The manual financial close process is the traditional way of closing financial books. It relies on people and paper systems instead of tools or technological solutions. This method involves several steps, like gathering data, making journal entries, reconciling accounts, and preparing financial statements. All these tasks are carried out by finance staff, who must carefully check each step. While this method provides careful oversight, it can take a lot of time and is prone to mistakes, making it less efficient than modern automated methods.

Automated Financial Close Process

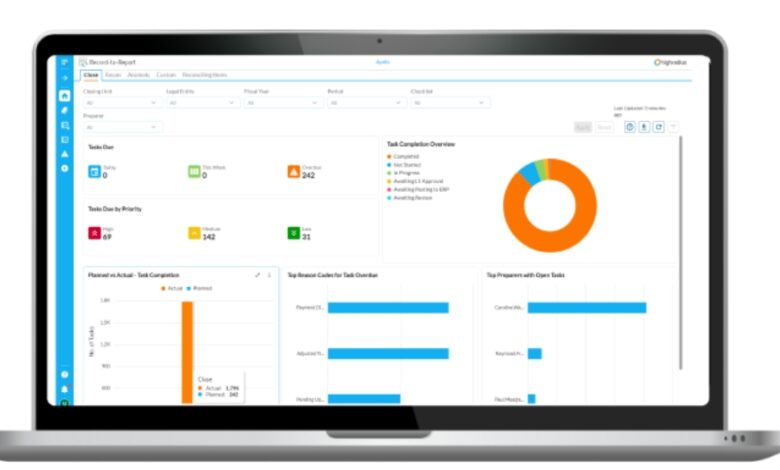

The automated financial close process uses technology and tools like Financial Close Software to streamline and speed up the closing of financial books. Instead of relying on manual tasks, this method integrates various financial functions, allowing for real-time data collection and processing. Key steps include automatic data gathering from different sources, generating journal entries with minimal human input, reconciling accounts through automated checks, and preparing financial statements quickly.

Choosing Between Manual and Automated Close Process

To understand the best approach for your organization, it’s essential to evaluate the specific needs and challenges you face. Let’s take a look at these factors.

Speed & Time

One of the major factors that businesses must consider when choosing between manual and automated financial close processes is the speed and time required to complete them.

The manual closing process can take several days or even weeks. Each step—ranging from data collection to journal entry creation and report generation—requires time and meticulous attention. Finance teams often find themselves buried in paperwork and checking and rechecking data. This can delay crucial financial insights and hinder decision-making.

An automated close process dramatically speeds up these tasks. Automated systems allow for real-time data collection and processing, enabling finance teams to close their books much faster. Many routine tasks, such as data entry and account reconciliation, can be completed almost instantaneously.

Efficiency & Accuracy

Next comes the factor of how efficiently and accurately your finance team is performing the financial close process. Efficiency is critical in ensuring that the closing tasks are completed within the required timeframes, while accuracy is vital for maintaining the integrity of financial data.

For instance, spreadsheets are often used for reconciliation in manual financial close processes. While they can be helpful, they are also prone to errors. These errors can lead to serious issues if not fixed quickly, increasing risks for your organization. Relying heavily on spreadsheets can also slow down the financial close, as time is wasted on reviewing and correcting inaccuracies.

Here adopting an automated financial close process can streamline operations. Advanced tools can perform automated data checks and balances, reducing the risk of human error and enhancing accuracy. This means financial statements are not only produced more quickly but also with greater reliability.

Visibility & Control

Having good visibility and control over the financial close process is crucial for any organization. When leaders can easily track progress and identify issues, it helps prevent mistakes and ensures that everyone is on the same page.

However, using spreadsheets for the financial close often results in limited visibility and control, which can hinder an organization’s overall effectiveness. When adjustments are made during the closing process, they can easily slip through the cracks. This means the manual nature of spreadsheets can lead to inconsistencies in how data is recorded and reported. This not only complicates the closing process but also impacts the accuracy and reliability of financial reports.

In an automated financial close process, visibility and control become much more manageable and effective. With real-time tracking and updates, leaders can effortlessly monitor progress and quickly spot any discrepancies. This proactive approach helps prevent mistakes and ensures that the entire team stays aligned, resulting in more accurate and reliable financial reporting.

Conclusion

Nevertheless, the decision between manual and automated financial close processes hinges on a variety of factors specific to your organization. Both manual and automated financial close processes offer distinct advantages, but their effectiveness can vary based on your company’s size, complexity, and growth trajectory. Manual processes may serve smaller businesses well in the short term, offering hands-on control and familiarity. However, as complexity and scale increase, the limitations of manual methods—such as inefficiencies and a heightened risk of errors—become more pronounced.

Implementing an automated financial close process with the help of financial close software can lead to notable gains in efficiency, accuracy, and visibility. With operations streamlined and real-time insights at their fingertips, finance teams can shift their focus to strategic decision-making instead of getting caught up in repetitive tasks.

Keep an eye for more news & updates on Tech Pro Magazine!